How to calculate Australian duty and GST when you import from China to Australia?

How to calculate Australian duty and GST when you import from China to Australia?

Australian duty/GST is paid to AU customs or government who will issue an invoice after you make Australian customs clearance

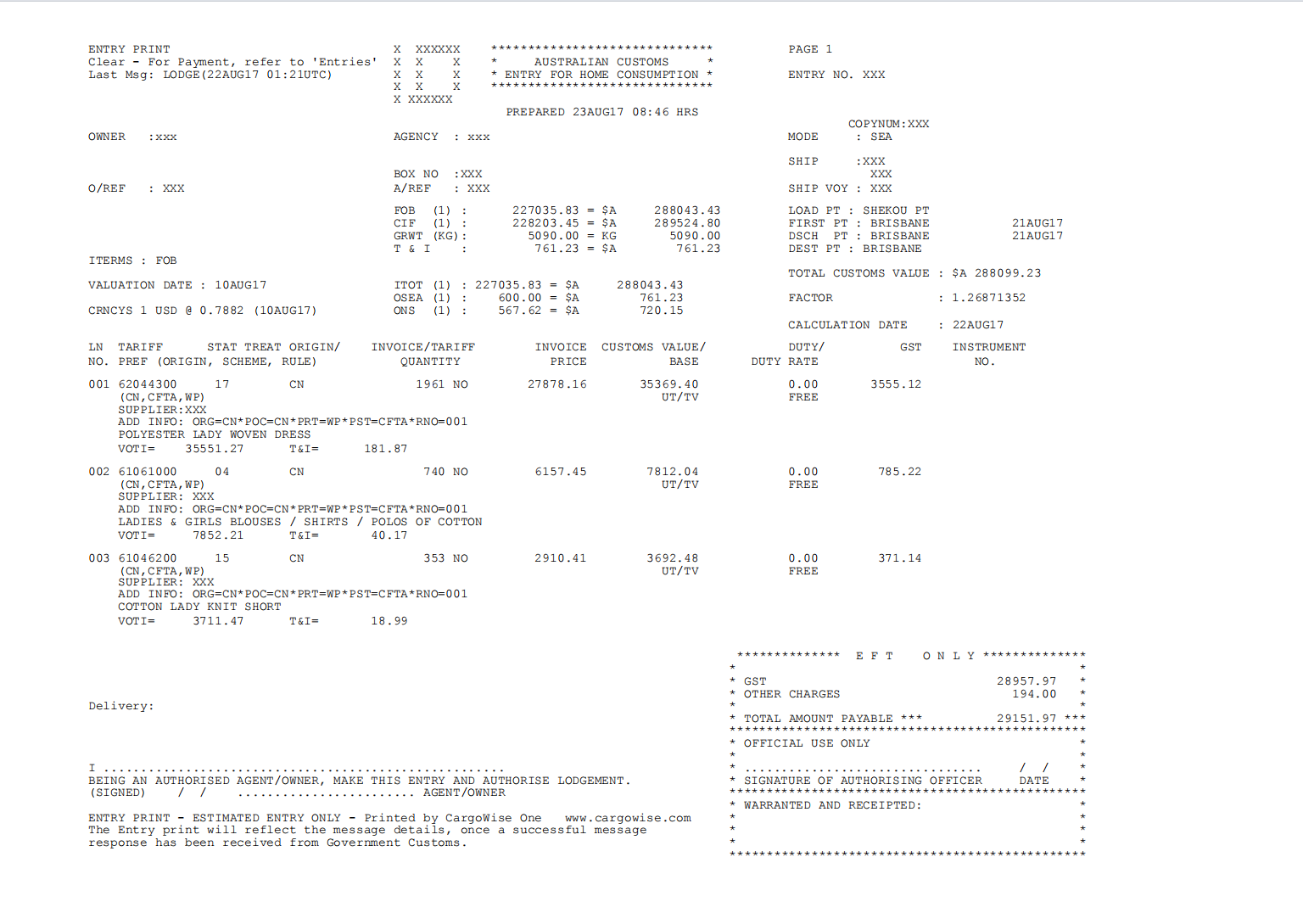

Australian duty/GST invoice consists of three parts which are DUTY, GST and ENTRY CHARGE.

1.Duty depends on what kind of products.

But as China signed a free trade agreement with Australia, if you can provide FTA certificate, more than 90% of products from China are duty free. FTA certificate is also called COO certificate and it is used to demonstrate that the products are made in China.

2.GST is the second part you need to pay to AU customs when you import from China.

GST is 10% of cargo value which is easy to understand

3.Entry charge is the third part that AU customs would charge and it is also called as other charges. It is related to cargo value which is usually from AUD50 to AUD300.

Below is an example of Australian duty/gst invoice issued by AU customs :

However, if your cargo value is less than AUD1000, you can apply for zero AU duty/gst. Australian customs would not issue an invoice

For more information pls visit our website www.dakaintltransport.com or email us at robert_he@dakaintl.cn or telephone/wechat/whatsapp us at +86 15018521480

SHIPPING SERVICE CATEGORIES

-

Phone

-

E-mail

-

Whatsapp

-

WeChat

-

Top